Customer churn rate is one of the most important metrics for any business with recurring revenue. Tracking and understanding churn rate is crucial to retain customers and revenue. This comprehensive guide will cover everything you need to know about churn, how to calculate customer churn rate, what a good churn rate is, and proven ways to reduce churn.

Key Takeaways to Calculate Churn Rate (Also Reduce Customer Churn Rate)

- Churn rate shows the percentage of customers leaving your product over a given time period

- Know the benchmarks for good and bad churn rates specific to your industry

- Track churn rate over time, not just a one-off number

- Monitor customer churn rate AND revenue churn rate

- Use cohort views, not just aggregate analysis, to diagnose underlying churn issues

- Identify at-risk customers based on behavioral patterns and health scores

- Survey both current and exiting customers to pinpoint drivers of churn

- Improve onboarding and ongoing training to boost retention

- Actively gather all sources of customer feedback

- Roll out frequent upgrades and new features to maintain engagement

- Staff customer success teams for high-touch support

- Create loyalty programs with exclusive perks and pricing

- Offer tiered products at diverse capability and budget levels

- Automate more touchpoints and account management

- Enable online community for user conversations

- Allow flexible plan pausing instead of one-way cancellations

What is Churn and Why it Matters

Churn refers to the percentage of customers that stop using your product or service within a given timeframe. It is also known as customer attrition rate.

Churn rate measures the number of customers you are losing and the pace at which existing customers are leaving.

Knowing your churn rate is essential because losing customers means losing revenue. High customer churn rate indicates dissatisfaction or lack of value from your offerings. By tracking churn rate you can quickly identify issues and improve customer retention rates.

For SaaS companies and other subscription businesses churn directly impacts revenues and profitability. In fact, a 5% improvement in retention can increase lifetime customer value by 125%, according to Bain & Company research. Furthermore, it costs 5-25x more to acquire new customers vs. retaining existing ones.

This is why churn must be closely monitored and addressed. Let’s examine techniques to calculate current churn rate, what benchmarks successful companies see, and most importantly – how to reduce customer churn.

Calculating Customer Churn Rate (Churn Rate Formula)

Customer churn rate calculation is simple:

Churn Rate = Customers Lost / Total Number of Customers

To calculate churn take the number of customers you lost in a month and divide it by the total number of customers at the beginning of that month. The result is the percentage of customers that churned that month, also known as monthly churn rate.

You can calculate churn rate for different periods – per month, quarter or year. Monthly customer churn rate will give you the quickest insight if churn is rising. Yearly calculation will show you longer trends.

Here is an example customer churn rate formula:

Monthly Churn Rate = Customers Lost Last Month / Total Customers at Start of That Month

Let’s look at calculating monthly churn rate for a SaaS company with 10,000 customers:

- January 1st: 10,000 customers

- January 31st: 9,800 customers

- New customers gained in January: 100

To calculate January monthly churn rate:

- Lost customers in January = 10,000 – 9,800 + 100 = 300

- January churn rate = Lost customers / Starting base = 300 / 10,000 = 3%

This monthly churn rate of 3% means 3% of customers discontinued service that month.

For even more detail, you can track churn rate by product, customer segment, geography, channel source and other attributes. Advanced analysis lets you pinpoint the highest areas of churn.

Benchmark studies find that average churn rate for SaaS businesses falls around 5-7% monthly. So is 3% a “good” churn rate? Let’s explore that next.

What’s a Good Churn Rate vs. Bad Churn Rate?

An average churn rate varies greatly by industry. SaaS and online services tend to have 5-8% monthly churn, while subscriptions for physical products seeing 15-25% monthly churn.

Annual contracts like newspapers and gym memberships average 5-10% and 30-60% attrition respectively. Of course these differ whether consumer vs. enterprise focused.

Here are typical customer churn rate benchmarks by sector:

- SaaS companies – 5-7% monthly churn

- Online services – 5-8% monthly churn

- Subscription boxes – 15-25% monthly churn

- Newspapers/magazine subs – 5-10% annual churn

- Gyms and health clubs – 30-60% annual churn

A good way to analyze churn is to track trends over time and set goals to continually lower churn. Comparing your SaaS churn metrics to close competitors can also be useful for context on the market position.

Ideally, you want to see churn rate decrease over time as you improve customer retention rates. Even a small change down has a big impact – just a 5% improvement in retention boosts lifetime value by 125% based on researcher modeling.

While tracking gross churn rate is important, analyzing additional churn metrics around customer segments, revenue impact, and cohorts over time gives a clearer picture.

Let’s examine some of these other key churn metrics to know.

Customer Churn Rate vs. Retention Rate

Retention rate is the opposite side of the coin from churn rate.

Rather than showing the percentage of customers lost, retention rate measures percentage of continued customers.

If your churn rate is 5%, then the retention rate is 100% – 5% = 95%.

Monitoring retention rate is another helpful benchmark for customer loyalty trends, especially when measured year-over-year or quarter-over-quarter.

Revenue Churn Rate

While customer churn rate shows the percentage of customers leaving, revenue churn rate measures the direct revenue impact of those departing customers.

This matters especially if churning customers were high-paying clients, causing an outsized revenue hit.

Calculating revenue churn helps assess ongoing revenue risks and opportunities to improve.

Calculate Revenue Churn Rate:

Monthly revenue lost from churn / Total revenue at start of month

First take the total monthly recurring revenue (MRR) from customers who churned. Divide it by the MRR for your entire customer base at the start of that month.

For example, if you lost $5,000 in September MRR from churned customers, and your total MRR entering September was $100,000 – then the September revenue churn rate is 5%.

The goal is for revenue churn rate to trend below customer churn rate over time. This indicates you are successfully retaining bigger clients, while churn stems from smaller accounts.

Analyzing Churn by Cohorts

Cohort analysis tracks churn rate for “cohorts” – groups of customers that signed up in a given period.

For example, you could compare monthly churn rate of:

- January 2023 cohort

- February 2023 cohort

- March 2023 cohort

Seeing higher early churn for recent cohorts can indicate worsening onboarding and training. If older cohorts have increasing churn, it may signal a need for more upgrades and feature releases to maintain engagement.

Cohort views provide better insight than aggregate churn rate alone, to diagnose underlying issues.

Customer Health Scores

Leading indicators can identify at-risk customers before they churn. A customer health or engagement score uses metrics like:

- Days since last login

- Recent support ticket volume

- Payment failures

- Pageviews

The algorithm rolls up multiple metrics into a health rating for every customer. Low health scores signal customers needing attention to prevent churn.

Customer health scores allow outreach to potential churners before it’s too late. Proactive account management is essential to save them.

Now that we’ve covered various churn metrics and analysis methods, what should you do when churn rate is too high or rising? How do successful SaaS companies retain and expand their customer base?

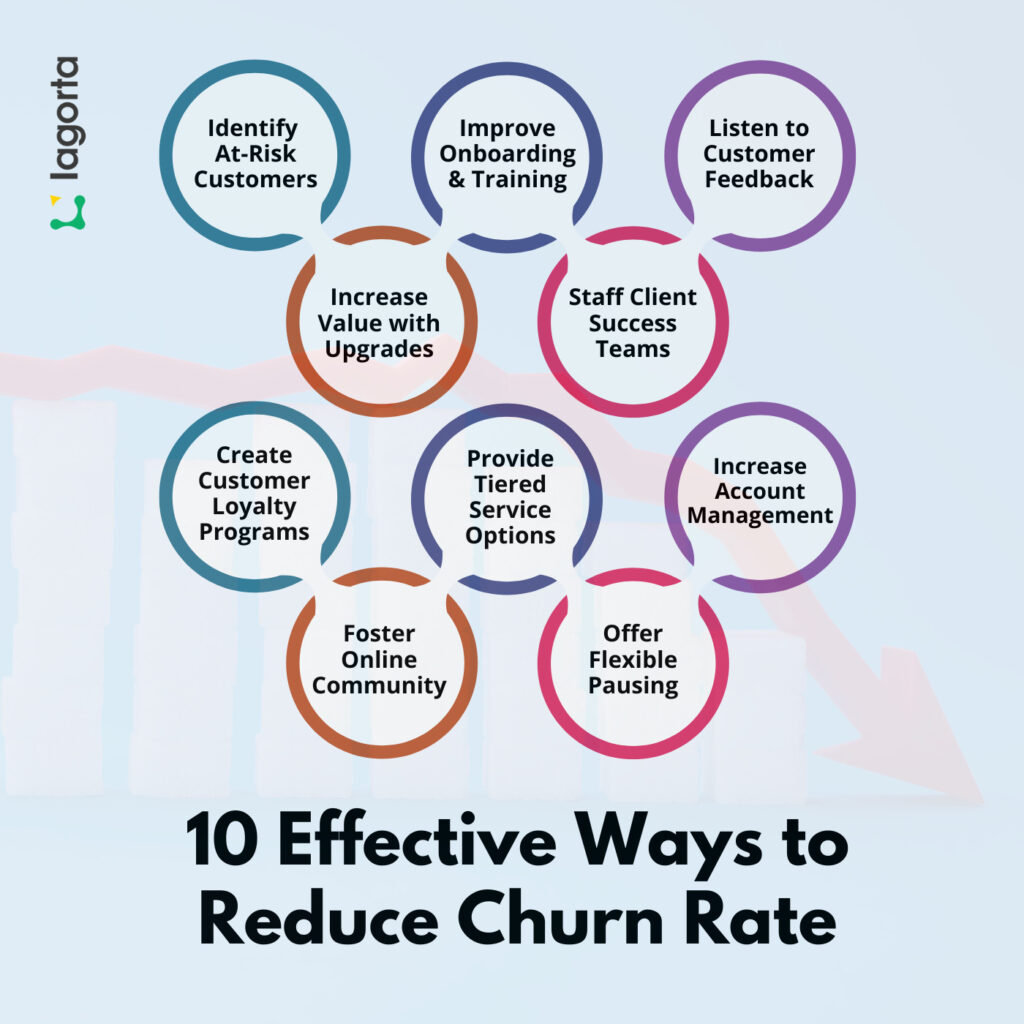

10 Effective Ways to Reduce Churn Rate

No company wants to lose customers, so what strategies can improve loyalty and boost retention when churn gets out of hand?

Here are ten proven tactics to reduce churn:

1. Identify At-Risk Customers

Use analytics to profile existing customers that are most likely to churn based on behavior patterns and other attributes of past churners.

Common signals include:

- Less engagement

- Payment issues

- Support tickets

Create an automated at-risk scoring model and rules engine to take action.

Reach out to high-risk segments through proactive surveys, calls and special offers to re-engage them. Get ahead of problems before it’s too late. Assign account reps for high-touch outreach.

2. Improve Onboarding & Training

Many customers churn due to initial confusion in an app’s purpose or how to use features correctly.

Better educating customers upfront on how to successfully use your product prevents early frustration.

- Provide in-app tutorials

- Self-guided walkthroughs

- Live onboardingconsultations

- Training checklists

Confirm new users see core value fast. Ask for feedback on any points of confusion.

3. Listen to Customer Feedback

The best way to improve retention? Continually listen to customer opinions through:

- In-app and email surveys

- NPS (Net Promoter) score

- App store and social media reviews

- Support discussions

Actively gather all channels of customer feedback and monitor for common complaints. Identify root causes of dissatisfaction. Analyze feedback by exiting customers to isolate reasons for churn.

4. Increase Value with Upgrades

Long-term user value correlates strongly with retention. Ensure customers gain more benefits over time:

- Roll out regular new features and upgrades current users will enjoy

- Provide special access to early previews

- Identify upsell opportunities to higher-tier plans

- Reward loyalty with pricing perks and promos

Research shows extending capabilities and recognizing commitment curbs churn.

5. Staff Client Success Teams

No user wants to feel ignored or struggle alone. Designate internal staff as client success managers or customer advocates for high-touch consultations and support.

Make it easy for customers to quickly get expert help when needed. Ensure sufficient staff to maintain responsiveness as your userbase scales.

Well-trained teams building personal connections with customers greatly impacts retention and satisfaction long-term.

6. Create Customer Loyalty Programs

Special recognition and exclusives make customers feel valued, investing them in your brand’s success.

Offer special perks, early access, and promo pricing for high-value or long-term customers to increase retention. Identify brand evangelists to spotlight. Extend unique VIP benefits.

Loyalty programs lift engagement and satisfaction levels, making churn less likely.

7. Provide Tiered Service Options

Diverse customers demand options matching their current needs – from small teams to enterprises.

Provide tiered offerings and pricing for the spectrum – entry-level, professional, premium etc. Ensure clear paths to upgrade capabilities when ready.

Give customers room to grow rather than hit dead-ends. Guide them to fuller engagement over time through billing consultations.

8. Increase Account Management

Out of sight means out of mind. Consistent customer interactions keep your brand top of mind while uncovering expansion opportunities.

Automate workflows and messaging for regular touchpoints – profile updates, recaps of key features, integration suggestions etc.

Trigger manual outreach for any warning signs like payment failures or dormant logins. The personal touch matters most when heading off churn risks. Assign account management roles.

9. Foster Online Community

An active community strengthens bonds between customers as peers with shared challenges.

Connect users through forums, chat, and social channels that let them help each other solve problems. Enable self-service through user generated content.

Seed conversations around vertical use cases and best practices. Community builds advocacy and organic growth.

10. Offer Flexible Pausing

Sometimes customers simply need temporary flexibility in tough times. Rigid all-or-nothing policies fast-track cancellations unnecessarily.

Rather than permanently lose churners, allow customers to temporarily pause accounts for 1-3 months – due to finances, seasonal business cycles or evaluations of alternatives. Keep door open.

Win back churners with comeback offers after they see the grass isn’t greener elsewhere. Second chances prevent long-term regret.

While concrete tactics matter, ultimately reducing churn stems from a stellar customer-centric culture obsessed with satisfying users.

Prioritize simple, intuitive product design. Seek genuine customer feedback. Continuous improvement must drive engineering roadmaps and product decisions. When customers love the product and company behind it, retention comes easier.

“`

Frequently Asked Questions (FAQs)

1. What is churn rate?

Churn rate is the percentage of customers at the beginning of a period who churn or discontinue their service during that period.

2. How do you calculate customer churn rate?

To calculate customer churn rate, you can use the churn rate formula by dividing the number of customers who churned by the total number of customers at the beginning of the period, then multiplying by 100 to get the percentage.

3. What is customer retention and why is it important?

Customer retention refers to the ability of a company to retain its existing customers over a specified period. It is important as it helps reduce churn and improve customer retention, ultimately leading to increased revenue and loyalty.

4. How can I analyze churn and reduce churn rate?

It is crucial to track churn and understand the factors contributing to a higher churn rate in order to reduce your churn. By analyzing churn, you can implement strategies to improve customer retention and low churn rate.

5. What do I need to know about churn rate and revenue churn?

Churn rate and revenue churn rate are key metrics that measure the percentage of revenue lost due to churn. It is important to know about churn rate and revenue churn as they directly impact the financial health of a business.

Monitoring churn metrics isn’t just about damage control. It’s a huge opportunity to constantly improve.

Analyze not just vanity metrics but actionable predictors of churn risks in your customer base. Diagnose why customers leave through exit surveys and warning signs.

Engineer retention into your roadmap priorities. Fix UX pain points. Level up onboarding and support. Celebrate long-term customers.

By taking the right data-driven approach, you can build an expanding base of happy loyal customers for the long haul. Your revenue growth and valuations will follow.